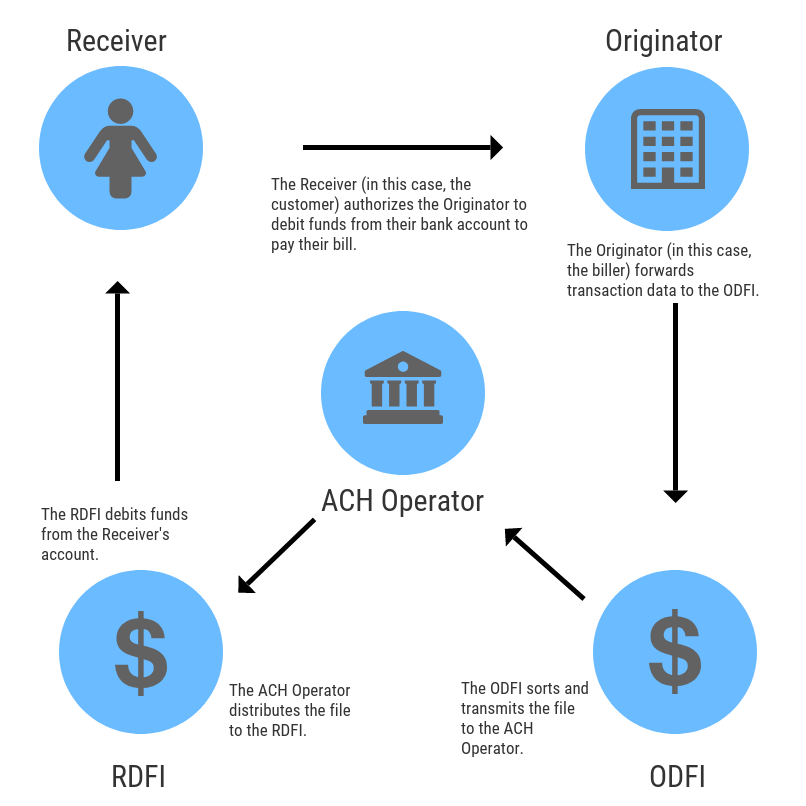

Firstly, direct ACH payments and deposits are more secure than checks-they can’t be lost, stolen, or forged. ACH fees vary by bank but are typically cheaper than credit card payments.ĪCH payments are most often used as an alternative to checks, wire transfers, and credit card payments and using ACH has clear benefits over these methods. Two-day payments are the most affordable, and therefore the most common. How fast your payment is completed depends on whether it is a same day, next-day, or two-day payment. One important thing to note is that ACH payments are not processed instantly-instead they are sent out in batches by your bank, which are processed by the Clearinghouse four times a day. For additional security, make it a habit to confirm the recipient of any ACH payment you are sending with a phone call to verify you have the correct routing information. Always check to ensure that any email address is coming from an official domain and secure website. Not sure if it’s an ACH payment? If you provided your routing number, chances are you are initiating one.īe on the lookout for potential scammers requesting to change payment information via fraudulent email addresses. You can initiate ACH transactions through online banking portals of ACH bank accounts (many common banking accounts are ACH compatible), but also through places like PayPal, Venmo, Zelle, as well as other payment portals online when you set up automatic payments or one-time payments using your bank account. These payments always involve two bank accounts, one that sends the money, and one that receives it. ACH payments are often offered as one of the many treasury products in banks (more on these below). And credit cards let you pay for your purchases without having to handle cash, while protecting your purchases from fraud.ĪCH stands for Automated Clearing House, and these forms of payment are a type of EFT that are processed by Automated Clearing House Network of financial institutions, managed by Nacha. ATM transactions allow you to access your bank account funds from anywhere in the world.

For example, Venmo payments allow you to easily pay back friends without worrying about having the right amount of cash. There are additional specific benefits for individual types of EFTs, which vary based on the product. Plus, they’re safer: you never have to worry about your funds being physically lost or stolen. Whether it’s paying for an online purchase using your credit card, or getting your biweekly paycheck directly deposited, EFTs eliminate the hassles of cash and checks. The main benefits of using EFT payments are convenience and security. This includes all online bill payments and purchases, direct deposit, ATM withdrawals, credit and debit cards, eWallet payments, and payments through apps like Venmo. If you initiate and/or approve of the transaction using technology, it’s an EFT. EFT is an umbrella term, and EFTs are any transfers of money that are authorized electronically-i.e., not initiated in person, manually, like withdrawals at the bank counter. Keep reading to learn more!įirst, let’s start with EFT, which stands for Electronic Fund Transfer.

#Ach transaction deposit how to#

In this post we’ll define each term, discuss how to make an ACH payment, and when using ACH transactions-over other forms of EFT payments-makes the most sense. Knowing what sets apart ACH banking from other forms of electronic payment is important, especially for small businesses who not only need to send many payments each month, but also receive them. But when it comes to business banking, it’s important to know the difference between certain products and services, as choosing the right tool for the right transaction can not only save you money, but can also save you time spent accounting and managing your business finances.ĮFT (Electronic Funds Transfer) and ACH (Automated Clearing House) payments are two of the most commonly conflated financial terms. With so many acronyms in the banking industry, keeping them all straight can be a tedious process.

0 kommentar(er)

0 kommentar(er)